Airbnb Service fees and occupancy taxes

Let’s dive into the pretty dry topic of fees, occupancy taxes, and what they’re all about. I hope you’ve had a strong cup of coffee or three because if you’re like me you don’t love the idea of dedicating yourself to understanding fees and taxes. If you do spend a little time understanding hosting and guest fees you will make better and more informed pricing decisions and be able to explain them to your guests which will improve their experience as well.

What are Airbnb service fees and how do they work?

Frustrated as we sometimes are about host fees, cleaning fees, guest fees, we all understand that a company needs to charge a service fee for its and Airbnb is certainly no different. Everyone has bills to pay am I right? Understanding those fees will greatly help you explain them to guests when they ask, and it will help you make informed pricing for your rental.

There are two different fee structures for stays: a split fee and a Host-only fee. I’ll go through the different options and you can best decide which works for you. There are some variations in fees for Italy and mainland China which we’re not going to dive into here but this is a great starting point with the topic.

Split fee pricing

The split fee structure is the most common and is divided between the host and the guest. Every hotel I’ve stayed in since becoming an airbnb host has charged this type of fee, and it is the default choice when you set up your Airbnb listing.

Airbnb Host service fee

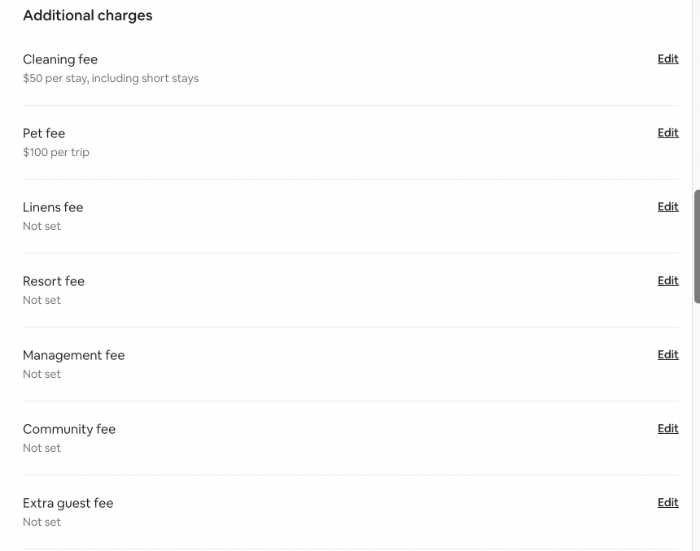

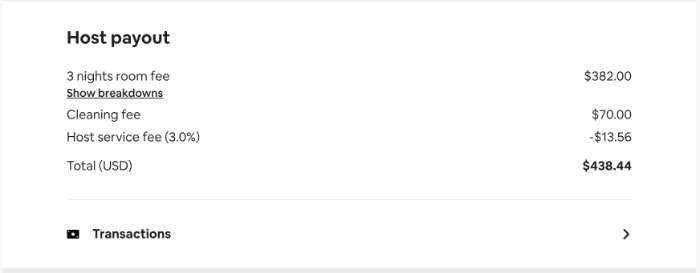

Most Hosts pay a host service fee of 3% which is deducted from your payout. The 3% is calculated from the total amount you charge your guests. There are a myriad of additional fees you can charge guests and I try to keep it as simple as possible with a nightly rate plus a cleaning fee.

Fees you can add: an additional guest fee, a pet fee, a cleaning fee, a linens fee, a resort fee, a management fee, a community fee, etc. I’m VERY confident in saying if you add a whole bunch of these small addon fees your guests are going to be annoyed. Basically, If you charge guests $100 then the Airbnb’s fees calculator is going to pay you $97. Pretty simple right?

How to find the exact host service fee amount for a booking:

There are a couple of ways to find your payout breakdown but the easiest is from the reservations panel and scroll to see the payout amount. Airbnb shows you what the guest paid and what you were paid right there.

The second option is to:

- Go to Insights, earnings, transaction history

- Select the reservation code

- Under Payout, find the Airbnb Service Fee

Guest fee

Guest fees are typically around 14% of the booking subtotal (nightly rate plus any fees you add to their reservation. Some circumstances change this but keep in mind that your guests can see the breakdown at check out.

To have or not to have a cleaning fee:

A cleaning fee is something you can add to your nightly price that let’s guests see what you are paying your cleaner or paying yourself to clean your property. Hotels don’t typically break cleaning fees out so guests aren’t always used to seeing them this way. Although Airbnb has been breaking cleaning fees out since the beginning. In the United States hosts must commit to paying a living wage to their cleaners and aside from it being required by Airbnb it’s just the right thing to do. Pay your people well and they will be loyal to you. Plus a spotless home leads to happier guests which leads to more money for you.

To have or not to have a cleaning fee:

I’m embarrassed to admit that it was a full year after Airbnb gave hosts the choice to pay a host-only fee and allow guests to just pay the nightly rate they see advertised when they’re looking for a listing. Guests get fired up about a million fees tacked on at checkout so there’s a real argument to test this simplified guest fees option. One thing I recommend is including addon fees like linen fees into your nightly rate.

When you select the whole service fee option it is deducted from the Host’s payout like the split-fee option. The fee is a flat 15%.

So again, your guest fees are taken care of by you, the host, but they will still pay occupancy taxes.

How airbnb service fees compare to other booking platforms

VRBO host cost: 5% (vrbo has a couple of different fee options for hosts but 5% is a good general rule.

VRBO Guest cost: 7% – 10%

The service fee on a booking is calculated on the sum of the property rental amount, pet fee, owner fee, and cleaning fee. This percentage amount can vary between 7-10%

Homeaway: 6–12% for guests.

Booking.com: The average fee they charge hosts is 15%, but that can vary by region and listing.

What are occupancy taxes?

Occupancy taxes are levied on the rental of rooms, apartments, or houses. They are also sometimes called guest taxes or lodging taxes. Do you remember hearing the hotel lobby complain that Airbnb wasn’t collecting taxes and how unfair it was? Airbnb paid attention to this noise and started collecting occupancy taxes back in 2015. The tax rate varies from place to place but the revenue remitted to local governments is huge.

Where do occupancy taxes go?

I’m not a tax expert by any means but I did want to understand where these taxes were going because I’ve had guests complain over the years about how much these are. In North Carolina where I live the rate is around 14% but that periodically changes like all tax policies.

In general, the tax collected goes into the local general fund. Much of the fees collected are used for tourism-related projects and according to the Magellan audit of North Carolina for 2016 the state collected 246 million. Yes, I read this lengthy and boring 47-page document so you wouldn’t have to…

“…generally speaking, the use of occupancy tax revenue in North Carolina falls into one of five categories:

1. Destination promotion

2. Tourism-related expenditures, which includes uses varying from staging festivals and events to providing some municipal services in beach towns

3. Funding or debt support for tourism-related capital projects such as convention centers and arenas or visitor attractions

4. Beach renourishment

5. General fund revenue and other non-tourism uses”

Why should you know where occupancy taxes go?

Aside from it being a good policy to know where your tax dollars go and how they are managed by elected officials when guests comment on them you can just politely let them know they are helping improve the lovely place they are visiting which wouldn’t be nearly as nice if they weren’t paying taxes. On the Outer Banks in North Carolina beach rebuilding is a major expense and storms wash away parts of the beaches every year. Without those beaches why would guests visit a beach destination?

In case you don’t live in an area where beach renourishment happens it’s the process of rebuilding a beach that has been eroded over time. It is a common practice in coastal areas around the world and can be used to restore beaches to their original state or to improve their overall condition.

(There’s not much of a beach in front of my Airbnbs there?)

Hopefully, you understand what the various booking platforms are charging, what occupancy taxes are all about, and how to explain them to yourselves and your guests.

Happy hosting and talk to you soon!